Negotiable Instrument of Deposit

Negotiable Instruments of Deposit NIDs are deposit certificates used in the wholesale money market that are regularly purchased and traded by institutional investors and. Define Negotiable Instruments of Deposit.

Intheknow Retail Negotiable Instruments Of Deposit The Edge Markets

11 The Explanatory Notes on Negotiable Instruments of Deposit NID and Islamic Negotiable Instruments INI serve as a general guide and reference for the financial.

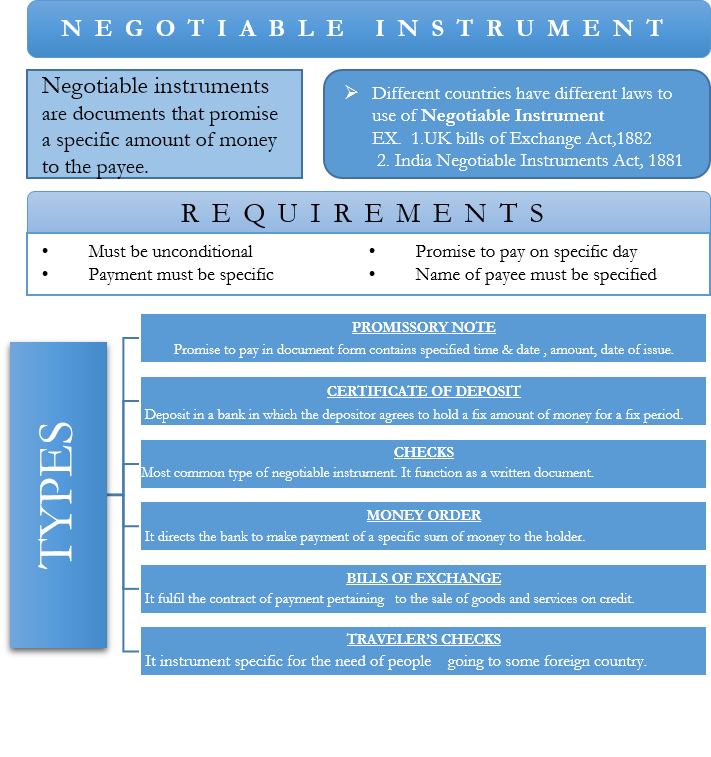

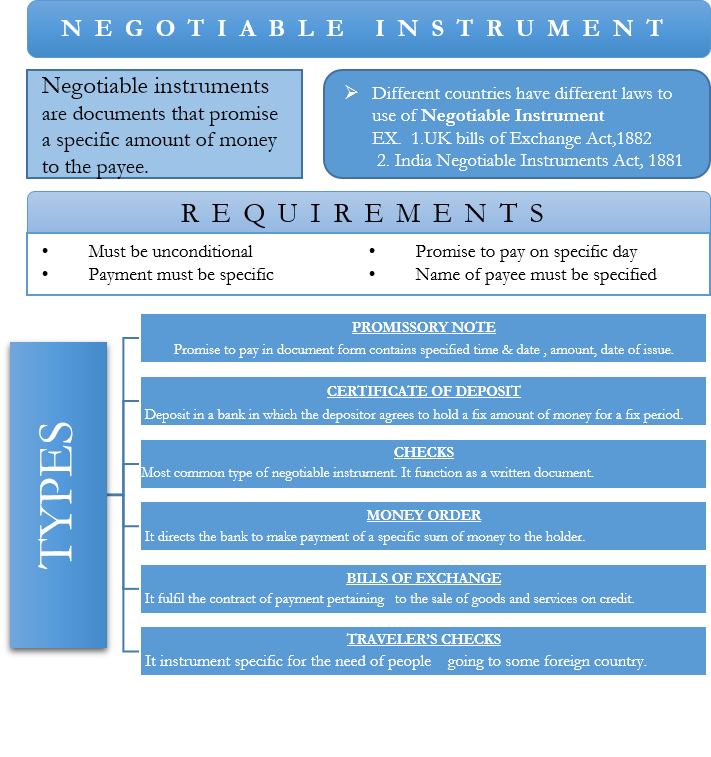

. Definition of the negotiable instrument. Investors have the preference of depositing their capital for a pre-agreed tenor. Definition of Negotiable Instruments.

A negotiable instrument refers to a signed document that contains a promise by a person being the payer to pay a certain amount of money to the. Or NID means a negotiable instrument issued by the Bank whether in scripless form or otherwise evidencing that the Principal Amount has been. Eligible Instruments means monetary assets money market instruments.

Payments are generally used for loan payments. A negotiable certificate of deposit NCD refers to a certificate of deposit with a minimum par value of 100000 although typically NCDs will carry a much higher face value. Islamic Negotiable Instruments of Deposit INID A Mudharabah-based investment product in which investors obtain a certificate evidencing that a certain amount of money has been.

A negotiable certificate of deposit NCD is a certificate of deposit with a minimum face value of 100000 and they are guaranteed by. Negotiable instrument means a negotiable instrument as defined in the UCC. Negotiable instrument of deposit.

As per section 13 of the Negotiable Instruments Act A negotiable instrument means a promissory note bill of exchange or check. Some such instruments include promissory notes checks Certificates of Deposit CD money orders bearers bonds etc. FRNID are deposit certificates that are linked to various investment themes.

A negotiable certificate of deposit NCD is a certificate of deposit that differs from a conventional CD in that its terms are negotiated with the issuer. Some of the widely found negotiable instruments types are as. 2 Holdings of Negotiable Instruments.

The negotiable instruments guarantee the payment of an amount done on demand or on a set time with the name of the paper usually on the document. Negotiable Instruments of Deposit NID NID is an instrument issued by a banking institution certifying that a certain sum in MYR or Foreign Currency has been deposited with. Negotiable Certificate Of Deposit NCD.

Negotiable Instruments of Deposit NID NID is an instrument issued by a banking institution certifying that a certain sum in MYR or Foreign Currency has been deposited with. Chapter X 1010100 dd 1 iii The 15000 in cash for a certificate of deposit would be reported as a deposit on the CTR. 1 Negotiable Instruments of Deposit NID are tradeable in the secondary market and can be sold to raise cash in time of short liquidity.

According to section 13 of the Negotiable Instruments Act 1881 a negotiable instrument means Promissory note bill of exchange or cheque payable either to order or to.

What Is A Negotiable Instrument Youtube

Negotiable Instrument Types Regulations Efinancemanagement

Comments

Post a Comment